One of the useful ways to analyse company is by reading its financial report. There are generally two types of financial report: Quarter Report (QR) and Annual Report (AR).

All listed companies are required to disclose their financial reports at the given time period accordingly, they have to make it public via an announcement in Bursa Malaysia.

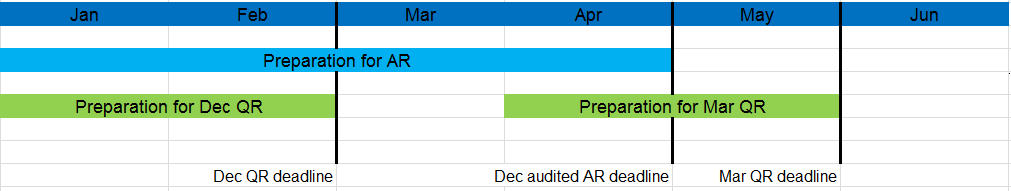

For QR, companies must submit the unaudited report within the period of two months from the reported date.

For AR, companies have to file the audited annual report within 4 months.

A majority of companies listed on Bursa Malaysia has the financial year end of 31 Dec.

Below shows a timeline of the financial report required for filing. (hope this wasn’t too confusing. let me know if it does…!)

Obtaining and analysing Financial Reports

Now is a blooming season for quarterly reports. More than 700 listed-companies announced their Quarter Reports for June 2017 in August. As an investor, how can we quickly filter scan through so many results and spot any potential investment?

Today, we are going to guide you step-by-step where to download and how to analyze a QR and AR within 10 mins!

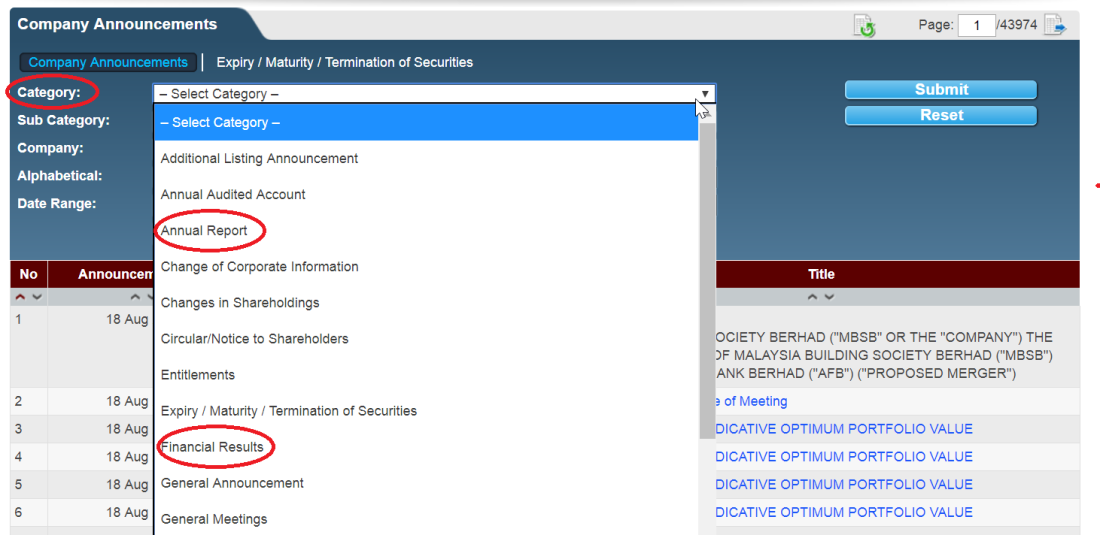

All the reports published can be found in Bursa website.

1. Go to “Listed Companies” -> “Company Announcements”

2. At the dropdown list of “Category”, choose “Annual Report” for AR or “Financial Results” for QR.

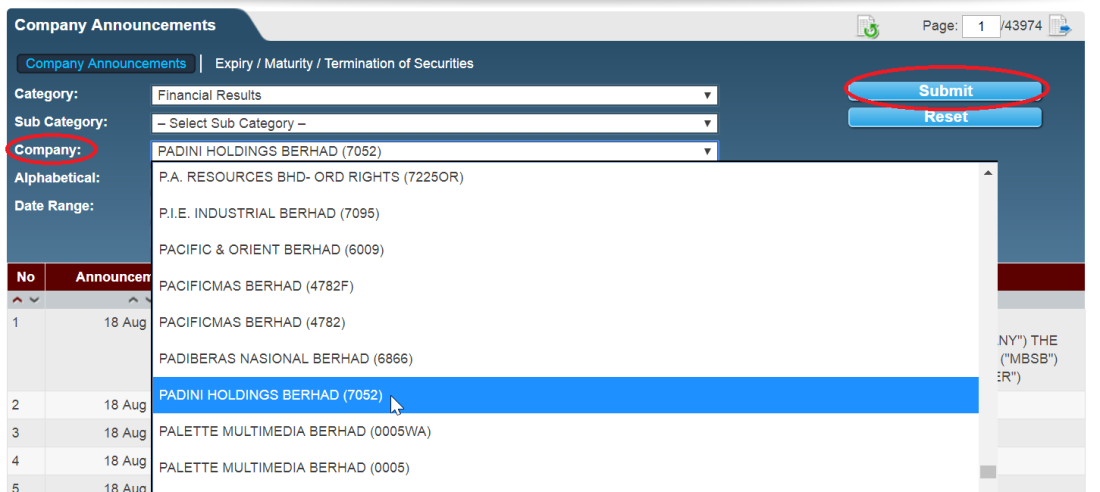

3. at the “Company”, choose your desired company and click “Submit”.

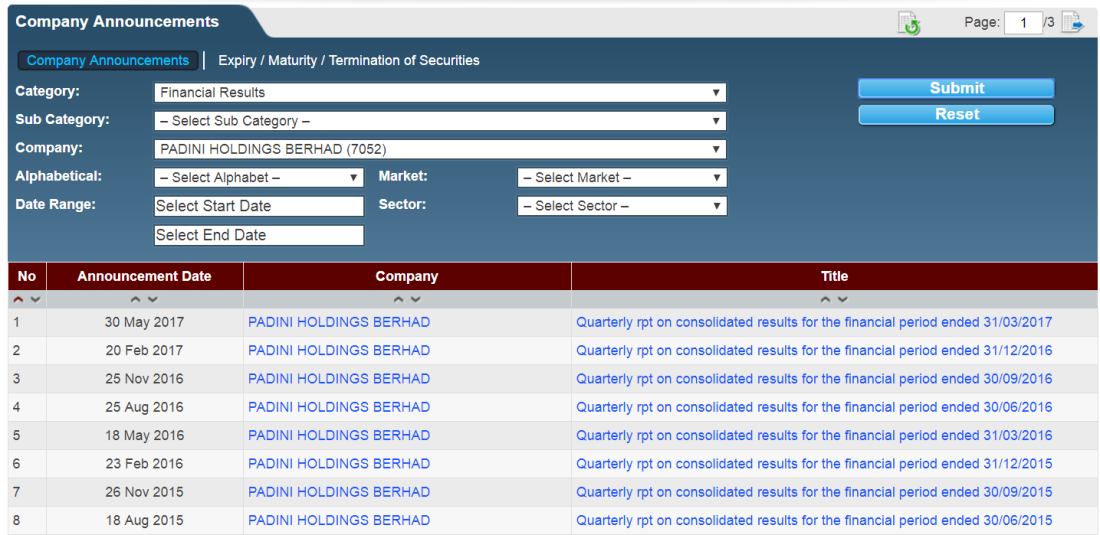

4. All published results are shown.

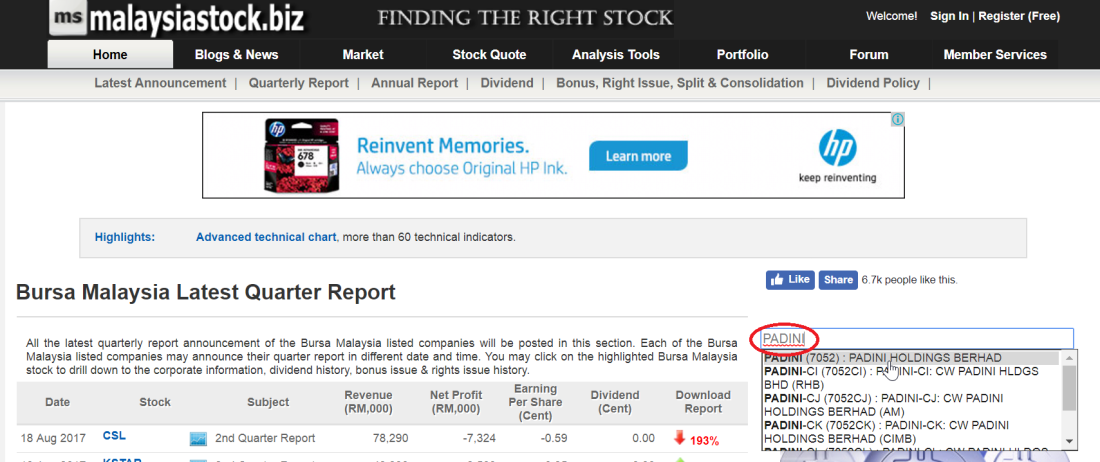

Or alternatively, you may go to this website (which I personally prefer). Simply type in the company name you are looking for at the red circle area, and all the past results, dividends, shareholder changes, latest announcement and news will appear.

It is important to equip with the skills to interpret the information we obtained, otherwise it is just useless sentences and figures.

Below, we highlighted the important parts to be aware of when reading both QR and AR.

Quarter Report

It is a brief report that discloses a company latest 3 months performance. It acts as a tool for listed companies to communicate or convince investors prior to the announcement of AR.

Things to focus on Financial Statement:

- Profit & Loss – Revenue, Other income, Gross and Net Profit

- Balance Sheet – PPE, Cash balance, Borrowing

- Cash Flow – One-off gain

Investors have to take note of the “one-off gain” or “non-operating income” that boosted the company’s results. Those are not generated from its sales and core business. And it usually gives false signal showing that the company is outperformed. These include, but not limited to disposal of PPE, revaluation of PPE, fair value gain and unrealized gain from foreign exchange.

Things to focus on Notes:

- Litigation – any court case that would affect companies liquidity

- Guaranteed profit – to forecast future earnings

- Performance review – know the reason why company is performing greatly/badly

- Commentary on Prospects – to understand what is going on in the industry, and how management sees its future.

I think this part is the most crucial part in the entire QR as it justified the performance of a company. If the revenue drop was due to reasons that can be resolved in short term (e.g lower demand in festival season, machinery break down, etc.), the company should back to its normal earning next quarter.

However, if the drop was due to lack of demand, losing out customers to its competitors or completion of projects, then, investors have to take note as the company might not able to retain its previous glorious in near term. We shall then focus on the ability of management and their future plan.

Annual Report

An Annual Report is a combination of 4 quarters audited results with a details information such as Company background, vision, Financial Highlights, Chairman Statements, Profile of Management team, PPE owned by the company and Substantial Shareholders.

Things to focus on AR:

- Chairman statement – to know how the business doing and the direction of the business.

- Profile of management team – as an investor, we must know who is the one managing the company. A team without a true leader won’t go far.

- Financial Highlight – 5 years company performance in a glance

- List of PPE – know what the company owned

- Substantial shareholder – to know who is the major shareholder, or which consortium has just bought in the company

The Qualitative of the company (all 5 points mentioned above) is extremely important. Having said so, investors must ensure the Quantitative of the company (financial statement) is not ignored. The AR disclosed the financial statement and notes to financial in a very detail manner. Although it is time-consuming, it is no harm paying more attention to those. Combination and understanding of both is essential.

If you like my article, please make sure you like my Facebook page here and share it with your friends!

If you have any question, you can buzz me on Facebook or email me.

FinDad checking out.